Ever walked into a shop for milk and somehow left with a basket full of things you didn’t know you needed? Or clicked “buy now” online, only to wonder what possessed you when it arrives? Welcome to impulse spending – where your brain and bank account are rarely on the same page.

The thing is, impulse buying isn’t about lack of willpower. It’s about understanding how our minds work and why spending money feels so satisfying in the moment, even when we know we’ll regret it later.

Why we buy things we don’t need

Your brain is hardwired to seek rewards, and buying something new triggers a hit of dopamine – the same chemical involved in eating chocolate or getting social media likes. Retailers know this, which is why they’ve perfected ways to make spending as easy and tempting as possible.

You can order something with one tap, pay without getting your card out, and have it delivered the same day. The friction between wanting something and having it has practically disappeared.

Then there’s the psychological side. Maybe you’ve had a stressful day and retail therapy feels like self-care. Perhaps you’re scrolling social media and everyone else has something you don’t. Or you’re just bored and online shopping provides entertainment.

None of this makes you weak or bad with money – it makes you human.

The tricks designed to part you from your cash

Understanding how you’re being influenced helps you make more conscious choices:

- Artificial scarcity: “Only 3 left!” or “Sale ends in 2 hours!” create fake urgency. Most times, if you came back next week, that product would still be available at a similar price.

- Social proof: “47 people bought this today” makes you feel like you’re missing out on something everyone else knows about.

- Buy now, pay later traps: Splitting payments makes expensive purchases feel affordable, but you’re still paying the full amount (plus fees).

The real cost of impulse spending

Those £5 coffee visits and £20 online purchases seem harmless individually, but add up faster than you’d think. Work out how much you spent on impulse purchases last month. Could that money have covered a weekend away or boosted your emergency fund?

There’s also the psychological cost. Buyer’s remorse – that sinking feeling when you realise you’ve wasted money – can create a cycle where guilt about spending makes you want to spend more to feel better.

Practical ways to think before you buy

The goal isn’t to never treat yourself. It’s about making deliberate choices rather than automatic ones.

- Try the 24-hour rule: When you want something non-essential, wait a day. If you still want it and can afford it without stress, go for it. You’ll be surprised how often the urge passes.

- Question the urgency: Ask yourself what happens if you don’t buy this right now. Usually, the answer is “absolutely nothing.”

- Calculate the work hours: How many hours do you need to work (after tax) to afford this? Sometimes “is this worth three hours of my time?” provides clarity.

- Make spending slightly harder: Delete shopping apps, remove saved payment details, or keep cards in another room. Small barriers give your rational brain time to catch up.

- Budget for treats: Give yourself a monthly “whatever” fund. When it’s gone, it’s gone, but until then you can spend it guilt-free.

When impulse spending becomes a problem

Occasional impulse purchases are normal. But if you’re regularly buying things to cope with emotions, hiding purchases from family, or using credit because you’ve run out of cash, it might be time to dig deeper.

Sometimes excessive spending is a symptom of stress, anxiety, or feeling out of control. If that sounds familiar, talking to someone about what’s driving the spending can be more helpful than just trying to force yourself to stop.

Making your money work for your actual goals

The money you don’t spend on impulse purchases can go toward things that actually improve your life – building an emergency fund, saving for experiences you’ll remember, or just having breathing room in your budget.

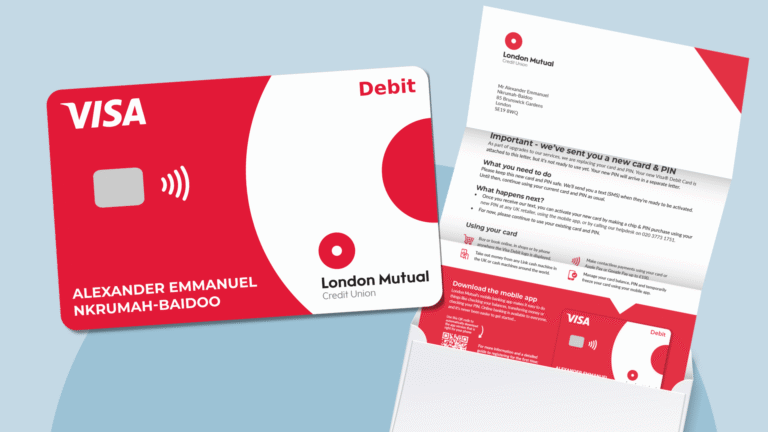

At London Mutual, we see how much difference it makes when people feel in control of their money rather than controlled by it. Our savings accounts help you put money aside before you have a chance to spend it, and our budget tools show you where your money actually goes.

Your brain will always want new things – that’s not changing. But understanding why you spend helps you make choices that align with what you actually value, rather than just what feels good in the moment.