The sun is out, the Euros are on, shops, gyms and restaurants are re-opening, and, according to the stats, many of us are on a spending spree. Consumer spending was up by a whopping 7.6% last month compared to 2019.

And more of that money than ever before is being spent online. Online retailers are doing all they can to tempt us with convenient free or next day shipping so that our purchases are with us in as little as a few hours. Home working has made it easier too, with the doorbell ringing as the deliveries from Royal Mail, Hermes, DHL UPS and Yodel arrive throughout the day.

The bad news? Scammers are in on these changing habits too. Last year we wrote about how fraudsters were exploiting concerns around COVID-19 to rip-off consumers. Well, like the rest of us, they’ve moved with the times. The latest scams are using the online shopping boom to find new ways to steal our personal information and money.

Text and Email Scams

Like most of these types of scams, the fraud relies on fooling you into entering your personal or payment details onto a fake webpage that looks just like the real thing.

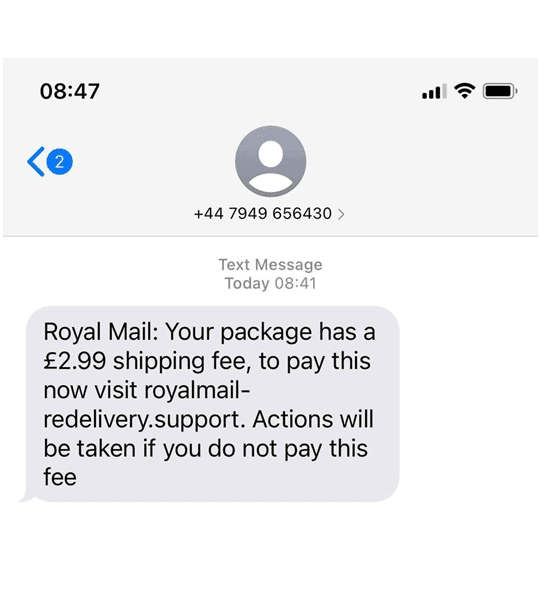

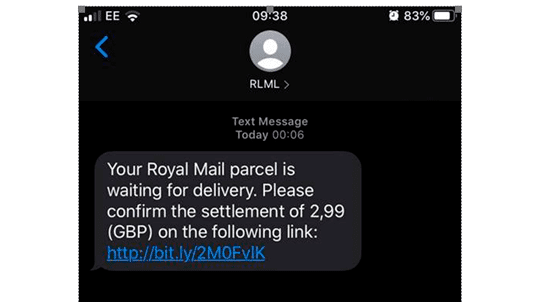

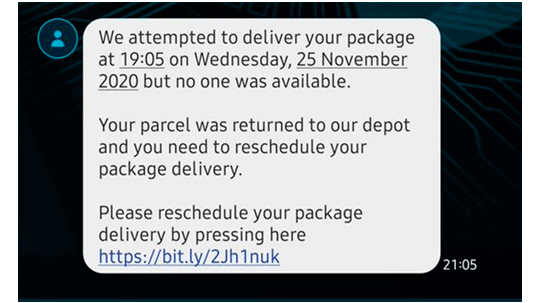

The latest version of the scam involves sending you a text or email that looks like it has come from Royal Mail, or another delivery company, telling you to click a link to pay a delivery charge or fee.

Examples

How the Scam Works

If you’re unlucky enough to click the links within the text or email, they will usually take you to a webpage. On this page, you’ll be asked to enter your personal details and payment information. You may then be asked to pay the ‘fee’ or ‘delivery charge’ that it says you owe.

This page will often be made to look just like the real thing. It may use exactly the same colours, logos and branding as the company it is pretending to be from.

But it isn’t. Fraudsters or criminal gangs typically run these types of pages. They may use the information you entered to steal money from your account. Or, they may sell your personal details on to other criminals for use in identity theft or other types of fraud.

How to Spot the Scam

It’s easy to see why this type of fraud is so widespread, because it’s so convincing. We’re all used to getting delivery updates via text, and may have paid delivery surcharges or return fees in the past. It’s easy to believe it’s the real thing, especially if we’re expecting a delivery from the company the message claims to be from.

Some of the most sophisticated scams of this kind can fool even experts. But luckily, there are a few things you can look out for:

- Think twice. Are you expecting a delivery? Do the delivery company and any tracking ID or information they’ve given match what you were expecting? If you’re unsure, check the confirmation email you received when you placed the original order to see if the details make sense.

- Check the sender. The email address or mobile number on the message can also be a giveaway. If the text is rom a random mobile phone number you don’t recognise, or if the email address doesn’t match the delivery company’s website, those should be red flags.

- Check the web address. Have a good look before clicking on any links. If the link is legitimate, usually, the web address will match the company’s main website, for example royalmail.com or myhermes.co.uk. Otherwise, if it’s something strange, or they are using a link shortener like bit.ly, think twice about clicking.

What to Do If You’re Caught Out

If one of these scams catch you out, don’t panic. It can happen to any of us, including to those you’d least expect to fall for it. The key thing is not to waste any time in getting everything sorted out.

- If you entered card details, contact your bank or card issuer immediately to tell them what happened. Ask them to cancel the card immediately, and to issue you with a new one.

- Report the scam to ActionFraud, the UK’s police anti-fraud agency. They’ll take you through an online questionnaire and issue you with a crime reference number. Hold onto this, as you may need to give this number to your bank or insurance company.

- Check your credit file. You’ll want to check that nobody has used your personal details to apply for a loan or take our credit. If they have, you’ll need to contact the credit agency to let them know it wasn’t you.