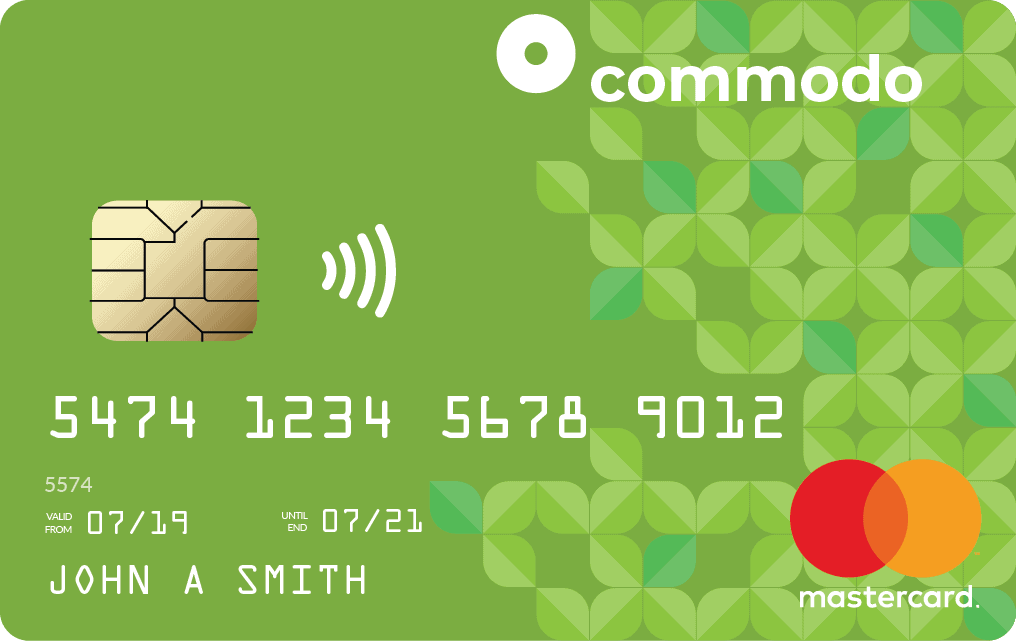

Commodo

The flexibility of a MasterCard®, with one fixed, salary deducted monthly repayment and safety tools that make it easy to pay off.

Example: £2,000 Credit Limit at 19.6% APR

All Loans are subject to our Lending Policy and Terms & Conditions

Get the flexibility of a payment card without the hassle

We asked our members what they wanted from a payment card, and what it was about credit cards and overdrafts that got them down. The result was Commodo; a flexible line of credit, linked to a convenient debit card.

It delivers the flexibility of a payment card, with one fixed, salary deducted monthly repayment and safety tools that make it easy to pay off.

How it works

Get a credit limit

Once your application is approved, we’ll set you up with a credit limit that you can dip into whenever you need.

Pay in salary

An agreed chunk of your salary will be paid in to your account each month. We’ll arrange this with your employer for you.

Contactless debit card

Use your contactless Mastercard® debit card to make in-store or online purchases.

Always there for you

Your limit is there whenever you need it. You’ll only pay interest (19.6% APR) on what you use.

Will I be approved?

As with all our loan products, applications are subject to a manual decision process. You are more likely to be accepted if:

You are currently keeping up with your existing repayments and other financial commitments.

You can comfortably afford the repayments alongside your existing financial commitments

What you’ll need

A copy of your most recent payslip

Your National Insurance number

Proof of Address

Key Features

Convenient contactless MasterCard debit card

Up to £2,000 credit limit (19.6% APR)

One fixed monthly repayment from your salary

Apply risk-free with no impact on your credit score

Eligibility Criteria

18-74 years old

Working for an eligible employer

Live or work in Southwark, Lambeth, Camden or Westminster, or working in health or education in Greater London

Keeping you on track

Commodo is provided by London Mutual, a not for profit credit union. The card include tools that make it easier to keep up with payments, and are designed to keep you out of problems with debt.

Salary deducted, fixed monthly payment

No need to worry about direct debits, or remembering to pay on time.

Balance by text

Know where you stand. Get your balance at any time with a simple SMS.

Save as you go

The option to pay in more than you spend each month, building savings.

Apply with no impact on your credit score

We do a ‘soft’ credit search so you can apply risk-free.

Gambling block

Betting and online gaming sites are blocked by default.

Eligible Employers

Commodo is available to staff at over 25+ NHS Trusts, local authorities and other local organisations, as well as members of the armed forces across the UK.

Good to know

Who can get Commodo?

Currently, Commodo is only open to existing members who are registered for payroll deduction (with savings or loan repayments taken from your salary).

As with any type of loan or credit, availability will also depend on your individual circumstances, including your other financial commitments and ability to repay.

What does it cost?

Your single monthly payment is the same each month, regardless of how you use the card. It includes your loan repayment, any fees, as well as interest, which is charged at 19.6% APR.

Your monthly payment is calculated as 1/18 of your agreed credit limit, plus interest. As an example, with a credit limit of £2000, your monthly payment would be approx £130 per month.

Why are the monthly repayments the same whether I use the card or not?

Paying the same amount each month makes it easy to budget and plan your finances. It also means you’re never more than 18 months away from paying off your balance in full.

If your monthly payment is more than what you owe us, the money you’ve paid in is still yours to spend later, or, if you prefer, we can transfer it into your savings.

Is Commodo a credit card?

No. Commodo is a debit card associated with a revolving loan facility, and is not a credit card.

One way to think of it is as both a loan and a current account. The loan is prearranged, and available to you whenever you need it, up to an agreed limit.

When you apply for the loan, we will also set you up with a credit union current account specifically for this purpose, through which you can access the borrowed funds. You can then access it whenever you need, using the debit card provided.

What happens if I change jobs?

Moving to another employer may mean we can no longer take your payment directly from your salary (unless your new employer also offers salary deduction with us).

You will remain a member of the credit union, but will no longer be eligible for a Commodo card. After your leaving date, you will no longer be able to use your card. Any balance left on the account will be converted into a loan with us (at the same rate of APR) and repayments will continue via direct debit. To make sure this all happens smoothly, please let us know if you are changing employer as soon as possible.

Is my application likely to be approved?

All applications will be considered by an expert member of our loans team, rather than by a computer or automated process. We think that’s fairer, because everyone is different and it allows us to get a fuller picture of your circumstances.

When considering your application, we’ll look at your previous credit history as well as your income and other financial commitments, to ensure the card is the right fit. Taking repayments directly from your salary means more security for us. This usually allows us to offer greater flexibility and better rates than other providers.

How does salary deduction work?

When you apply for Commodo, we’ll ask for details including your National Insurance number. If you work for one of the 25+ local organisations with whom we have a partnership, we will then provide your details to their payroll department, who will arrange the deduction on your behalf.

The deduction will usually appear on your payslip alongside national insurance, income tax, pension and any student loan repayments.

How will my credit score be affected if I apply?

When you apply, we’ll use a credit agency to check your credit status. We’ll conduct this as a ‘soft’ search, which means that there will be no record on your credit file if your application is not approved.

If you are approved for a card, we will regularly update credit reference agencies with information about your outstanding balance and repayments. Staying up to date with repayments is likely to have a positive impact on your credit file.

Because we make it easy to repay, this card may be a good way to build your credit score. On the other hand, missing or falling behind with payments will hurt your score, and may make it harder to get credit from us or other providers in future.

Which organisation do you work for?

Because your monthly Commodo repayments are deducted from your salary, you need to be employed by a participating organisation to apply.

To continue, please select your employer from the list below:

If you don’t see your employer listed here, unfortunately we can’t offer you a Commodo account.

However, if you live or work in Lambeth, Southwark, Westminster or Camden, are in HM Forces, are a health or education professional in Greater London, you may still be eligible to join us and to apply for one of our other loan products.