Credit Union Savings

Savings for rainy days (and brighter ones too)

Saving regularly isn’t just a good habit. It’s also about building financial resilience, so that when opportunity knocks, or the unexpected happens, you know you’ll be ready.

That’s why, whatever your situation, we make it easy for you to save, so you can get on with life knowing you’re prepared for anything.

Savings that suit you

As a member, you can have one or several savings accounts for different purposes. These accounts don’t come with a debit card.

Membership Account

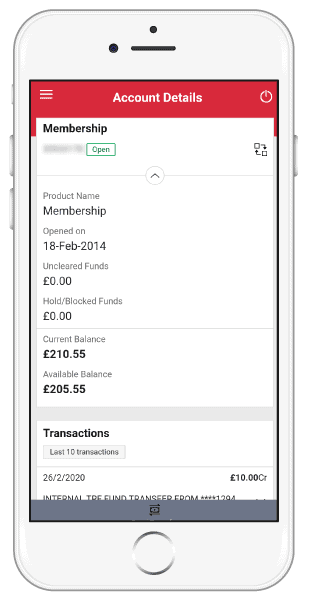

This is your main credit union account, for everyday savings. Deposit into your account regularly, and manage your money at any time via our mobile banking app.

Christmas Savings

Get ahead with Christmas planning. Save from January to December. The money is locked up until Christmas and we will not encourage you to withdraw until then.

Holiday Account

Get holiday planning underway with our Holiday Savings Account. Save as much as you want and as and when you want.

Fully Licensed and Protected

Eligible customer deposits with London Mutual Credit Union are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK's deposit protection scheme. Any deposits that customers hold above the £85,000 limit are not covered.

Ways to save

Salary Deduction

Have a regular amount deducted from your salary and paid straight into your savings.

Direct Debit

Set up a direct debit to pay regularly into your London Mutual savings account.

Debit Card

Top up your savings at any time from your own debit card via our secure page.

Over the Counter

Visit any of our branches to deposit cash into your savings account.

Access your money 24/7 via our Mobile & Web Apps

All London Mutual Credit Union members get access to our web and mobile apps. With all the time-saving features you’d expect, like face & touch ID, balances and payments, it’s never been easier to manage your money.

Good to Know

Learn more about how savings work.

How do I know my money is safe?

London Mutual Credit Union, like all UK financial institutions, is regulated by the Financial Conduct Authority (FCA) and authorised by the Prudential Regulation Authority (PRA).

Savers’ deposits are protected by the same Financial Services Compensation Scheme that covers banks and building societies. In the event that the credit union encounters financial difficulties, eligible deposits up to £85,000 per member are guaranteed by the government.

Do you offer online banking or a mobile app?

As soon as you join the credit union, you’ll receive membership number. You can use this to register for our Mobile and Web apps, which should take no more than five minutes.

Once registered, you can use your phone or devices’ face or touch ID to make it quick to log in and check your loan and savings balances, transfer your savings into your own bank or building society account, or make payments to others.

How can I adjust the amount I save each month?

Unless you tell us otherwise, your monthly savings contribution will continue after your loan is paid off. Because it comes out of your salary, there is a good chance that by then you will be used to not having it, so it’s a great way to get into the habit of saving regularly. You’ll be surprised how quickly it adds up. Of course, you can sto

What is my membership account?

All members receive a basic Membership Account when they join. This is a basic savings account which is designed for regular or one-off deposits from your salary or via direct debit, and which you can access using our Mobile or Web Apps.

Your Membership Account is designed to be used for savings, not as a current account. Because of this, it does not come with a debit card or its own account number or sort code. Many of our members already have a current account elsewhere, but if you would like to set up a current account with us, you’ll have the option to do this when you join.

Are there restrictions on accessing my money?

We encourage you to hold onto your savings for the long-term, but there are no specific restrictions on accessing or withdrawing money you have saved.

The only exception to this is if you have a loan with us. If you have a loan, the money in your main Membership Account is held against the loan, and you will be unable to withdraw it until your loan is paid off.

Can I borrow and save at the same time?

When you apply for a loan, you’ll have the option of also setting up an amount to save each month, in addition to your loan repayments. This is optional, but even if you can only afford £5 or £10 a month extra, it means that when your loan is fully paid off, you’ll also have built up a nice pot of savings which should mean you need to borrow less in future.

Will I receive any interest on my savings?

As a credit union, we do not pay interest on our accounts, but if the credit union makes a surplus (a profit), this may be distributed to members as a dividend. The amount of dividend paid will vary depending on how much you have saved with us. In recent years we have not made a surplus, and so no dividend has been paid. This may, however, change in future.

Do you offer an ISA?

We are not currently accepting new ISA applications, though check back as this may change in future. If you have an existing ISA with us, you may continue saving up to the maximum of £20,000 for the current tax year, with an interest rate of 0.1% AER.