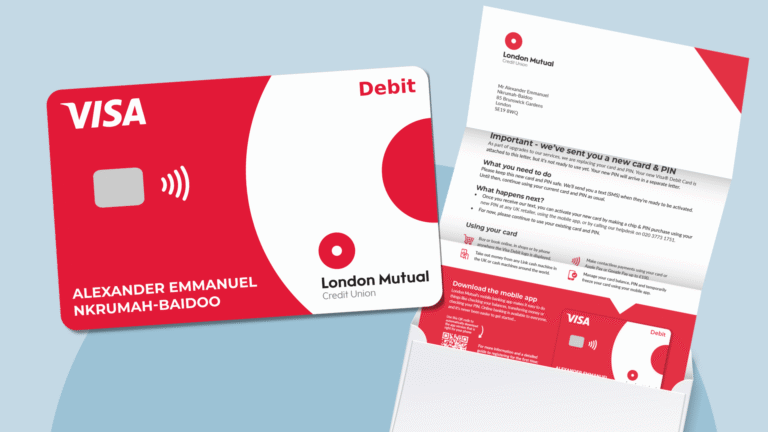

London Mutual Credit Union

Your money.

Your community.

Your credit union.

Banking that puts Londoners first — with fair loans, savings from your salary or benefits, people-first mortgages, and everyday services to help your money go further.

Get started

Leave your details and we’ll send you a quick email with the link and information on how to join.

We’ll use your details to email you information about joining London Mutual Credit Union. You can unsubscribe at any time. See our Privacy Policy for more.

Buy or re-mortgage for as little as 3.64% -our lowest-ever rate

Buy your first home or re-mortgage with the people-first approach you’d expect from your local credit union.

Rates from 3.64% (variable) discounted for 2 or 3 years before reverting to standard variable rate (currently 6.89%). All Mortgages are subject to our Lending Policy and Terms & Conditions. Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

About London Mutual Credit Union

We’re London’s largest community credit union, helping thousands of people make the most of their money.

Member-owned – a financial co-operative run for the benefit of our 42,397 members, not for profit.

Community roots – serving our communities in South London and beyond for over 40 years

Workplace partnerships – saving and borrowing direct from pay with the NHS, armed forces & public sector

Safe & regulated – Authorised by the FCA, with members’ savings protected up to £120,000.

Working with 30+ local employersto enhance colleague financial wellbeing

How it works

What do people say about us?

Tips & ideas

Get started

Get a credit union savings account

Apply to become a London Mutual Credit Union member with regular contributions from your salary, benefits or via Direct Debit

Join and apply for a loan

Apply for a loan at the same time as you join London Mutual, with great rates and simple and affordable repayment options.