We’re launching a smart, convenient alternative to credit cards, with fairness and simplicity at its heart.

Every day we work with members caught out by credit cards. And let’s face it: it’s far too easily to do.

There’s a lot that can go wrong. Fees for a missed payment, ‘introductory’ offers to hook you in, overseas transaction fees…the list goes on. And then there’s the ‘minimum payment trap’, where month after month, you make repayments, even as the card balance continues to climb.

For a long time, we’ve wondered if, as a credit union we could do better job for our members. We considered launching a fairer, better credit card product of our own, and did a survey of our members asking what they would look for in a card.

What we discovered was this: most of us value the convenience and flexibility of a payment card and a line of credit ready when we need it. However, we don’t like the complexities of credit cards. And for many of us, the risk of falling into problems is enough to put us off them altogether.

After almost eighteen months of listening to our members, we think we may have cracked it.

Our solution

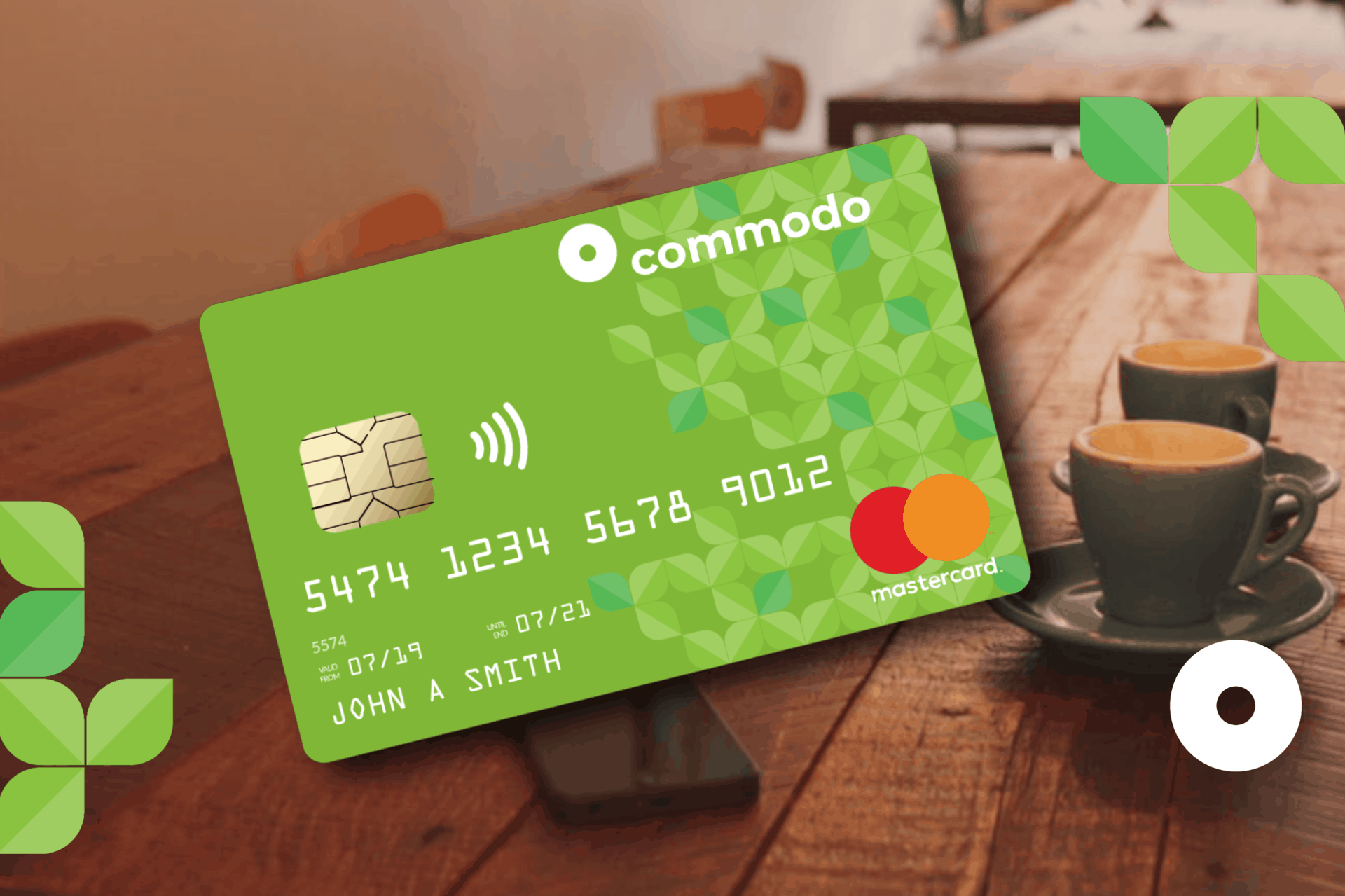

Later this summer, we’ll be launching Commodo, a new kind of payment card. It’s a loan card, not a credit card, and consists of a contactless MasterCard debit card with a loan facility of up to £2,000 linked to it, which you can spend as you need.

Simple enough. But the magic ingredient is our payroll deduction facility. With credit cards, you can forget to pay, or where you can get stuck in the minimum payment trap. Commodo is based on a single fixed monthly fee, which we deduct straight from your salary automatically.

The advantage of one monthly payment is that you know exactly how much you’re budgeting each month. It’s the same amount no matter how much you’ve spent on the card, and if you pay in more than you’ve spent, your card will build up a positive balance which you can either spend later, or move into your savings account.

How Commodo works

The monthly fee is calculated as 1/18th of your total card limit. This means that you’re never more than eighteen months away from paying off the card in full.

Because you told us safety matters, we’ve included features to keep you out of problems. These include free SMS balance checks, a gambling block, and the ability to ‘auto land’ your card at any time. If things get too much, you’ll have the ability to switch off the card functionality. You can then convert it into an ordinary loan with a fixed end date.

Oh, and for up to 30 days per year, your overseas transaction fees are on us. That way, you can crack on and enjoy your holiday.

We developed the card because we think there’s an appetite for a payment card that provides an alternative to credit cards by doing things in a simple and fair way.

And with over 600 members signing joining the wait list for when the card launches in a few months’ time, we’re excited to see that so many of our members agree.

How do I get a Commodo card?

If that sounds interesting, then make sure you sign up to hear from us when the card launches. There’s no commitment at this stage.

As a member-owned, not-for-profit organisation, we want to provide clever, convenient alternatives that keep our members in good financial health. That’s why we’re designing a loan card product which is built around fairness and our values.

We hope you like it.