Christmas Loans Cut-off - This year's deadline has now passed. Applications received now may not be processed in time for Christmas. More details

Credit Union Christmas Loans

Don’t get into a financial tangle this Christmas

If you choose to borrow this Christmas, a credit union loan could save you money compared to credit cards or overdrafts. Borrow between £100 and £7,500, with affordable monthly repayments directly from salary or benefits.

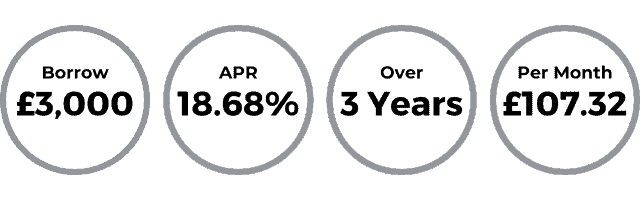

Example: £2,800 borrowed over 2 years at 18.68% APR. Total repayable: £3,330.60. All Loans are subject to our Lending Policy and Terms & Conditions

Example Loan:

Spread the Cost of Christmas

It can be an expensive time of year, so if you’re planning to borrow to spread the cost, we may be able to help.

A loan with your local credit union could save you hundreds of pounds in interest compared to going to a high street or online lender. And unlike credit cards and overdrafts, repayments each month are fixed, so you’ll know exactly how much it will cost and how long it will take to repay.

Key Features

- Get a loan for any purpose

- Decision in 10 working days

- No impact on your credit file if you are not accepted

- Decisions by a person, not a computer

- Build savings as you repay

Borrowing Options

Personal Loans

Borrow from £100 to £15,000 for any purpose with fixed repayments and a clear end date (from 9.38% APR)

Unemployed or Less-than-Perfect Credit

Our Booster & Growth loans could enable you to borrow up to £600 on your first loan (42.6% APR)

Existing Revolving Loan Members

If you are an existing revolving loan member, you can apply via SMS text message in the usual way before 10th December.

Got a Question?

If you’d like to know more about any of our loans, the application process, or any other aspect of our loans, our team are here to help.

Got a Revolving Loan Agreement?

If you are an existing member and have a revolving loan facility set up with us, applying for a Christmas Loan is as simple as sending us a text message.

To apply, send an SMS containing REV and the amount you would like to borrow to 60060, and you’ll receive an instant reply confirming whether or not we can approve your application.

Revolving Loans are subject to the Terms & Conditions of your existing Revolving Loan Agreement, well as specific eligibility criteria including your current financial and employment circumstances. (42.6% APR)

- YouREV 300

- LMCU Your loan can be approved. please reply "REV YES" if agree or "REV NO" if disagree

- YouREV YES

- LMCU Thank you. your loan of £300 is approved

Good to know

What Can I Get a Christmas Loan for?

We know that for many of our members, Christmas can be an expensive time of year. When money is tight, it can feel like there is no other option but to turn to expensive credit cards, overdrafts or even online lenders.

We think our members should be able to enjoy the festive season without worrying about money worries or falling into problems with debt.

That’s why, this time of year, we work to make sure that if members need to borrow a bit extra, they know they can do it with us. As a credit union, our rates are fair, and usually lower than other types of lenders.

How Quickly Will My Loan Be Processed?

We aim to process all loan applications and to let you know the outcome within ten working days (Mon-Fri, 9-5pm).

Because Christmas can be extremely busy, this timeline is not guaranteed, so we recommend getting your application in as early as possible.

To avoid delays, it is important that you upload all required information (such as payslips and bank statements) as soon as possible, as we can’t begin processing your loan until we have these.

What is the Deadline for Christmas Loans?

We know how important this time of year is. To make sure we have time to look at your application and to get the money to you in time for Christmas, please make sure you have applied before midnight on the 9th December.

You can apply online or in branch.

How Much Can I Apply For?

The amount we can offer you will depend on your individual situation. We consider things such as as your income, employment and your spending habits to decide whether the repayments are affordable to you. Sometimes, if we can’t offer you the full amount, we will be able to suggest a lower amount instead.

The main thing to remember is that you are more likely to be accepted if you apply for what you need. You should choose a loan with repayments at a level that you can afford to repay.

Do I Need to Become a Member Before I Apply?

No. Assuming you meet the criteria for membership, you will become a member of London Mutual Credit Union at the same time as you apply for your first loan. We’ll ask for all the information we need, so there’s no need to complete two forms.