With energy bills rising and Christmas around the corner, many of us are feeling the squeeze. But here’s something that might surprise you: millions of UK households are missing out on benefits and support they’re entitled to.

The amount will depend on your individual situation (and some people may be claiming everything they are entitled to already), but research by our partners Policy in Practice shows that an average of £2,700 per household is going unclaimed each year—so it’s well worth checking!

Two ways to explore your options

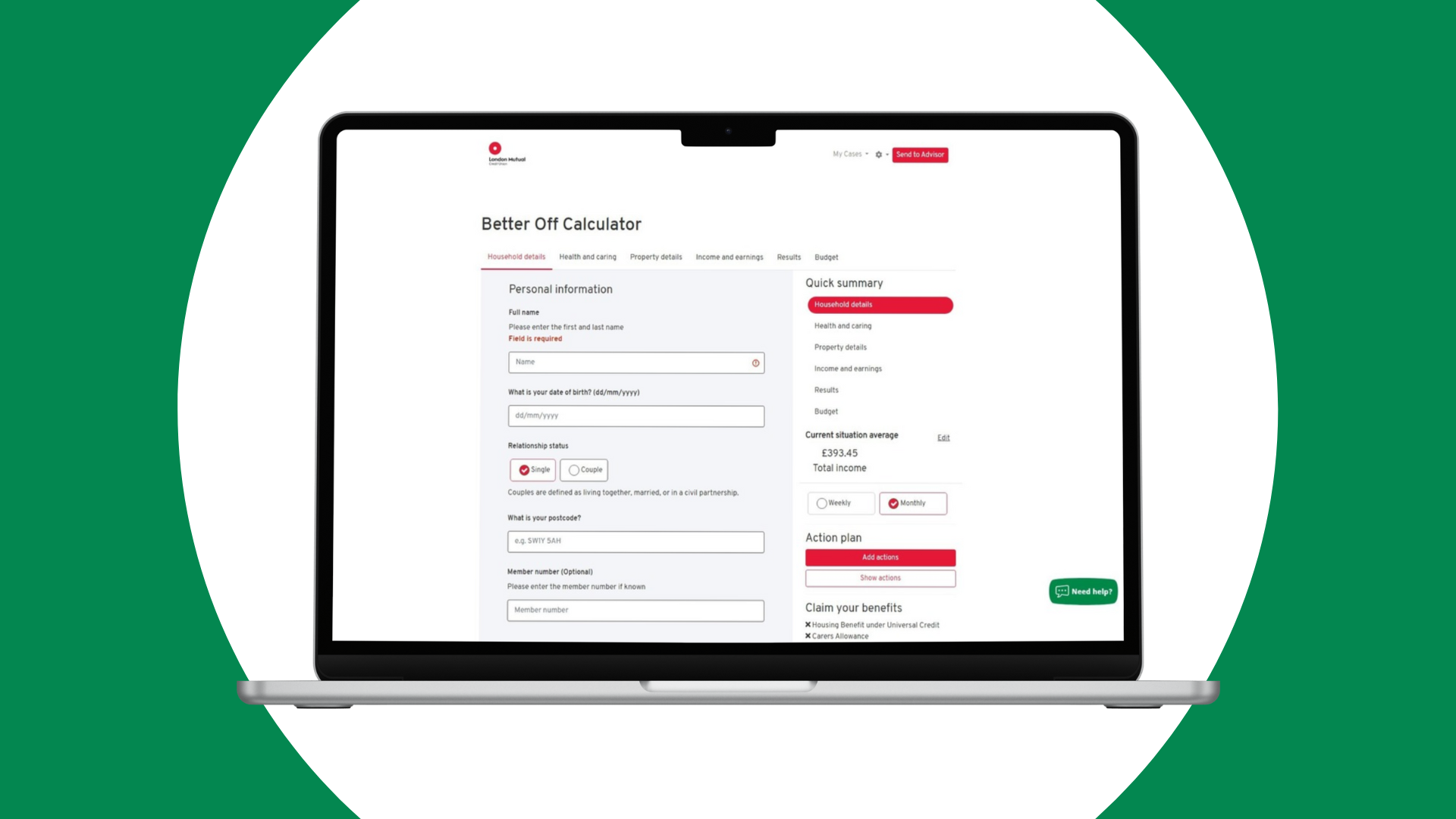

1.Use our benefits calculator on your own

Want to know if you could be better off? Our super-clever free calculator helps you:

- Make sense of your income and outgoings and understand exactly where it’s going

- Discover benefits you might not know you’re entitled to

- Find social tariffs that could cut your phone, broadband, or energy bills

- Learn about grants and support schemes in your area

- Get a clear action plan showing how you could be better off

Many of our members are surprised by what they find – even those who are working. Every year, billions in benefits and support go unclaimed. Even small amounts can make a difference, so isn’t it worth taking 10 minutes to check?

Visit the Better Off calculator

2. Book a Phone Appointment

If you’d rather speak to someone or would like a bit of a helping hand with the calculator, we might be able to help. We’re currently trialling a limited number of one-to-one phone appointments where we can:

- Help you understand how to use the calculator

- Talk through your current situation

- Explain what general support might be available

- Point you towards reliable organisations if you’re struggling and need specialist support or advice

It’s important to be clear that these appointments offer general guidance only, not financial advice. While we can help you understand your options and point you towards specialist help, we can’t give specific advice on what you should do or what specific products are right for you.

Appointments are available on a first-come, first-served basis, and slots are currently limited, but we are working to expand this service in 2025

To request an appointment, please take a couple of minutes to fill out the Financial Difficulty form on our website so we know a little more about your situation before we talk.

What to expect

Whenever you reach out to us, we will:

- Listen without judgment

- Help you understand what general support might be available

- Point you towards specialist independent advice if you need it

- Keep details of your situation confidential

- Never ask for PINs or passwords

- Never try to sell you anything

We can’t:

- Give specific financial advice

- Tell you which benefits to claim

- Make decisions about benefits or grants

- Complete applications for you

Need specialist help?

If you need immediate financial advice or specialist support, these organisations could be a good place to start:

- Citizens Advice: 0800 144 8848 (for help with benefits, debt, and consumer rights)

- StepChange Debt Charity: 0800 138 1111 (for free debt advice)

Take that first step

With Christmas approaching and bills going up, understanding your situation and having a plan of action is always going to be better than ignoring problems and worrying.

The Better Off calculator is available anytime via our website, and while our one-to-one calls won’t be able to help with every type of problem, we’ll do all we can to help you understand your options and, if we can’t help, to put you in touch with those who can.

So why not make a cuppa, put 10-20 minutes aside, and take the Calculator for a spin before the festive craziness gets properly underway? Your Christmas may thank you for it.