Take control of your finances with a credit union current account

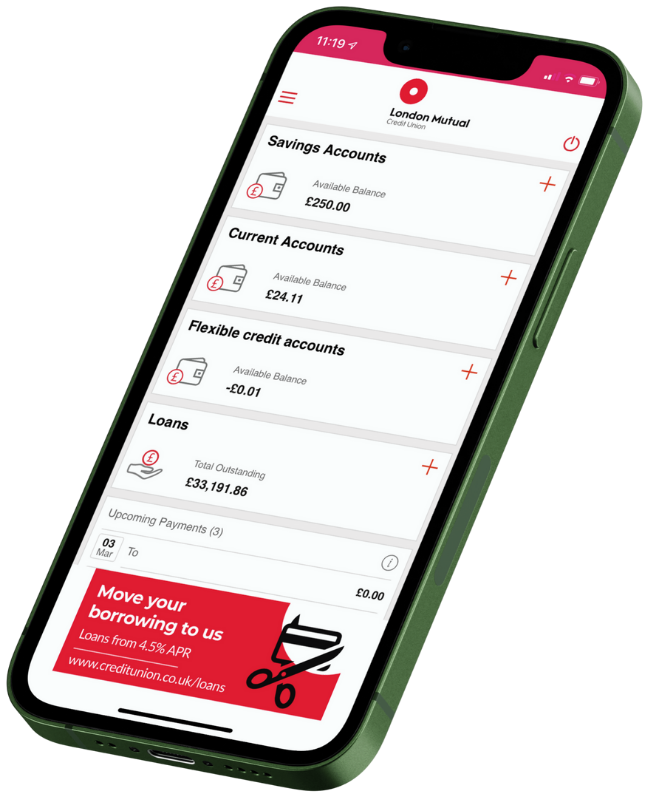

London Mutual Credit Union current accounts enable you to stay on top of your money day-to-day with an easy-to-use app and straightforward features.

Handy features to manage your account

Faster payments

PIN management

Direct Debits

Contactless Visa® Debit card

Spending notifications

Temporarily freeze your card

* Faster Payments are subject to automated fraud checks, and may occasionally be subject to up to 24 hours’ delay

** Spending notifications rely on registering for online banking, installing the mobile app on a compatible device and enabling push notifications.

Choose an account that works for you

Good to know

Protecting your money

Your eligible deposits are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme.

Who can open a current account with London Mutual?

Our current accounts are available to members of the credit union who meet our membership criteria. Applicants must also be UK residents and over 18.

If you’re not already a member, apply for membership first, and you can add a current account to your membership at the same time as you apply.

What documents do I need to open an account?

We’ll usually ask for proof of ID and address, as well as of your current employment or benefits.

If you’re struggling to provide these, we can often accept alternative documents—please contact us to discuss before you apply.

Do I have to have my salary or benefits paid in?

To be eligible for a current account with us, you need to have a regular income (such as your salary or benefits) paid into it.

To keep your account open, we ask that you agree to pay at least £80.00 a month into it.

Do accounts come with a Debit card?

All our paid-for accounts (which excludes the e-account) come with a contactless Visa Debit card.

Your card can be used to make purchases or withdrawals online or in store, anywhere in the world that Visa Debit is accepted.

Is my money protected?

Yes. Eligible deposits are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

Are there charges for using my account?

All our accounts that come with a debit card come with a monthly fee.

The number of monthly ATM cash withdrawals and balance enquiries included depends on the account type.

Using your debit card to make purchases, and checking your balance via the mobile app or online banking is always free.

How can I check my balance?

You can check your current account balance at any time using the mobile app and online banking. These tools are included in your account and free for all members to use.

If you use a cash machine (ATM) to check your balance, there may be a fee depending on your account type.

Can I upgrade or downgrade my account later?

Yes. If your needs change, you can switch between our account options—just get in touch.