Undoubtedly there is a connection between personal finance and mental well-being. At some point in your lifetime, you’ll feel stressed or weighed down by your finances. This is normal. And no, we aren’t saying everyone will get into unpayable debt or become bankrupt. Small things like not wanting to check your account after a big night out, or deciding if the money you spent on a takeaway was worth it, can still cause conflicting thoughts and anxiety.

It’s inevitable that sometimes you’ll over-spend, but it is important to realize how and when your money might be affecting your health. Knowing how to create good financial habits is a good way to avoid letting your money take over your well-being. Also, you should always remember that no matter what your financial or mental situation is, there are multiple options for help and support.

How are money and mental health linked?

Your money can negatively affect your mental health, and your mental health can negatively affect your money. Finances, spending, loans, credit, tax, the list of things we have to consider when it comes to our money is never-ending. It’s not surprising that doing simple things like opening letters or checking bank statements can cause anxiety. According to the Money and Mental Health Policy Institute, over 1.5 million people in England are experiencing problem debt and mental health problems.

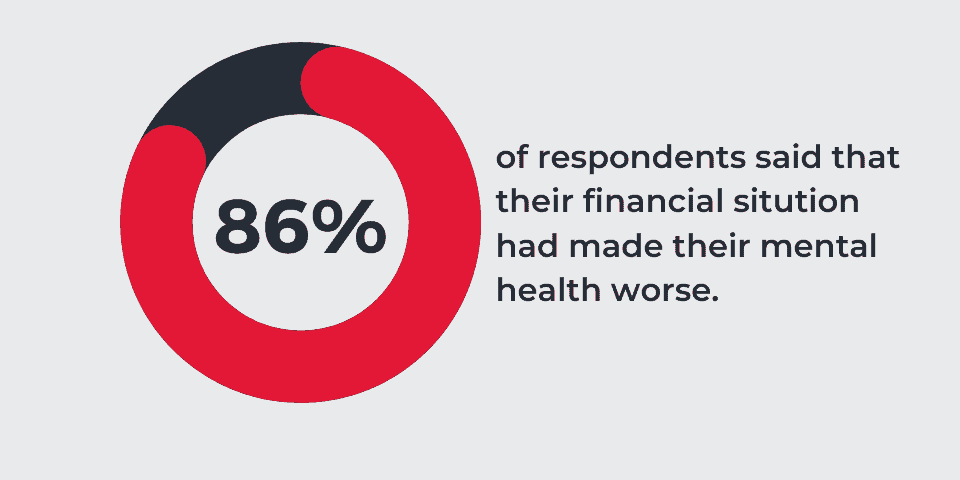

Money and Mental Health’s survey of around 5,500 people stated that…

Our tips

We believe the best way to keep track of your mental and financial well-being is to create good habits. We know it can be easier said than done, but here are some tips to get you on track:

- Never suffer in silence. If you’re starting to feel overwhelmed because of your financial situation you must tell someone. For example, if you have taken out a loan and are struggling to repay you should contact the lender ASAP as they will want to help you to find a solution.

- Learn to budget. Budgeting is so important when it comes to personal finance. If you begin to live outside of your means then you may end up in debt. Extra tip – include an emergency fund or impulse fund in your budget in case of an emergency. Get started with our free budget planner.

- Try to avoid impulse spending. It’s proven that impulse buying can cause a short-term high. But the key phrase there is ‘short term.’ You should also avoid buying things to keep up with trends, if you can’t afford it then you shouldn’t buy it.

- Get into a habit of saving regularly. This is one of the best financial habits to have. Having savings can help you out in the future if you come into any financial difficulty, or need some extra money to buy something you want/need.

Mental health charities

If you’re looking for some support or advice, there are multiple charities that can help:

Lambeth & Southwark Mind – Free, innovative, long-term services that empower and support everyone experiencing a mental health problem.

Maudsley Charity – Working in association with South London and Maudsley NHS Foundation Trust to promote positive change in the world of mental health.

Money and Mental Health Policy Institue – Tackling money and mental health problems.

Stem4 – Supporting teenage mental health.

The Money Charity – Financial well-being and education