The festive season brings joy, celebration, and often unexpected expenses. Whether you’re buying gifts for loved ones, hosting family gatherings, or simply trying to make Christmas special, the costs can quickly add up. If you’re considering borrowing money to cover Christmas expenses, understanding the difference between credit unions and payday lenders could save you hundreds of pounds and significant financial stress.

What are payday lenders?

Payday lenders are commercial companies that offer short-term, high-cost loans, typically designed to be repaid quickly. While they’re often marketed as quick and easy solutions for cash emergencies, payday loans come with extremely high interest rates that can trap borrowers in cycles of debt.

Some payday lenders are direct lenders who lend their own money, while others are brokers who match you with a lender (often charging fees for this service). Either way, the costs remain extremely high.

The true cost of payday loans

Despite regulations introduced in 2015 that capped payday loan costs, these lenders can still charge up to 0.8% interest per day. This translates to Annual Percentage Rates (APRs) that frequently exceed 1,000%, and in some cases reach as high as 1,625%.

Major payday lenders currently operating in the UK include Lending Stream, QuidMarket, and Mr Lender. While regulations mean you won’t repay more than double what you borrowed, this still represents an enormous cost for what might seem like a small loan.

Real example from Lending Stream: If you borrowed £300 for 6 months, you’d face:

- Monthly repayments of £96.39

- Total repayable: £578.36

- Total interest: £278.36

Real example from Mr Lender: If you borrowed £600 for 6 months at their typical 292% APR, you’d face:

- Average Monthly repayments of £92

- Total repayable: £552

- Total interest: £252

These eye-watering costs make an already expensive time of year even more financially challenging, with the debt burden extending well into the new year.

What are credit unions?

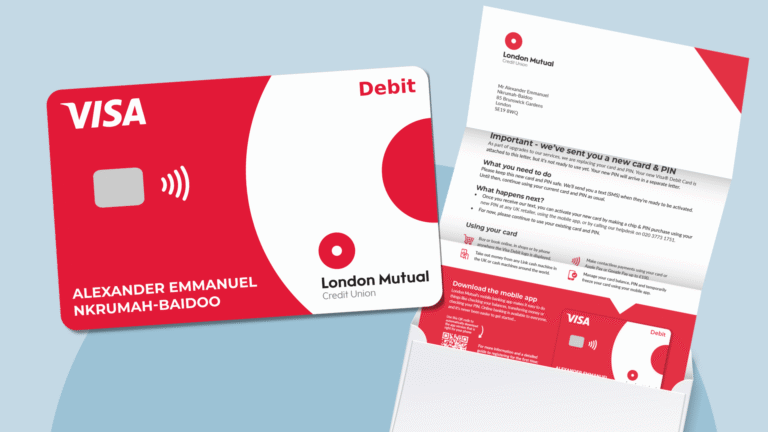

Credit unions are member-owned financial co-operatives that exist to serve their members, not to generate profits for shareholders. They offer affordable loans, savings accounts, and other financial services with the wellbeing of their members at the heart of everything they do.

London Mutual Credit Union is a direct lender – we use our members’ savings to lend directly to other members. There are no brokers, no middlemen, and no hidden fees.

Credit unions operate under a “common bond,” meaning they serve specific communities. In London, for example, London Mutual Credit Union (LMCU) serves people who live or work in Lambeth, Southwark, Westminster, or Camden, Transport for London employees, members of the UK armed forces, and those working in healthcare or education occupations anywhere in Greater London.

How credit unions approach Christmas lending

Credit unions take a fundamentally different approach to lending. Rather than viewing borrowers as an opportunity to make profit, credit unions assess your ability to repay and work with you to find a borrowing option that meets your needs.

The law caps interest rates at credit unions to 3% per month (42.6% APR maximum), which is a fraction of what payday lenders charge. Many of our members will get a rate even lower than this – for example, 19.50% APR on a £100 loan.

Key differences between credit unions and payday lenders

Interest rates and costs

The contrast in costs is stark. While payday lenders routinely charge APRs exceeding 200%, 500%, or even 1,000%, London Mutual Credit Union charges a maximum of 42.58% APR, and often even less – still significantly lower than many overdrafts and a fraction of payday loan costs.

The credit union option not only costs less overall but spreads repayments over a manageable period, making it easier to budget without the shock of huge monthly payments.

Repayment terms

Payday lenders typically require repayment over just a few weeks or months, with high monthly payments that can leave you struggling. This creates a dangerous cycle where borrowers take out new loans to cover the shortfall, accumulating more debt.

Credit unions offer flexible repayment terms tailored to your circumstances, often ranging from a few months to several years depending on the loan amount. This means you can spread the cost of Christmas over a manageable timeframe, with affordable monthly repayments that don’t leave you short.

Benefits-based repayment

One unique advantage of borrowing from London Mutual Credit Union for those receiving benefits is the simple, secure repayment method. When you’re approved for a loan, you’re provided with a credit union account. You then contact HMRC or the DWP to redirect your benefit payments into this account. Once the credit union sees your benefit payments coming in regularly, we’ll release your loan.

Each month, we automatically deduct your loan repayment from your benefits, and the rest of the money is yours to use as normal. This system provides:

- Security for both you and the credit union

- No risk of missed payments affecting your credit score

- Automatic, hassle-free repayment

- Peace of mind that you’ve paid your loan for that month

Save-as-you-repay: Building for the long term

Unlike payday lenders who simply take your money, London Mutual Credit Union encourages you to build savings while you repay your loan through their innovative save-as-you-repay scheme.

Here’s how it works:

- Each month, you’re encouraged to pay a little extra on top of your loan repayment – as little as £5

- We put this extra amount into your savings account, which we hold securely for the duration of your loan

- Once you’ve fully repaid the loan, the savings are yours to use as you see fit

- You’re encouraged to continue the monthly payment habit, but now it all goes into savings rather than loan repayments

Example: If you borrow £600 over 6 months with monthly repayments of £111, and add just £10 extra each month to savings, you’ll have £60 saved by the time your loan is paid off. If you continue saving £121 per month afterwards, you’ll have £726 saved within a year of starting your loan – enough to cover next Christmas without borrowing at all.

This approach helps you:

- Build an emergency fund while repaying debt

- Develop positive saving habits

- Reduce or eliminate the need for future borrowing

- Break free from the debt cycle that payday loans create

Application process

Payday lenders often boast about instant decisions and money in minutes. While this might sound appealing, it can encourage impulsive borrowing without proper consideration of whether you can truly afford repayments.

London Mutual Credit Union takes time to assess your application properly, ensuring you can comfortably afford the loan. This protects you from unmanageable debt.

You can become a member and apply for a loan at the same time – there’s no need to be a member first or meet minimum savings requirements before borrowing.

Member support

Payday lenders often pursue aggressive debt collection tactics when borrowers miss payments, including passing debts to third-party collection agencies, adding default charges, and damaging your credit rating.

London Mutual Credit Union lends based on what you can genuinely afford to repay. You’re borrowing money from fellow members, so we expect you to honour your commitments and keep up with agreed repayments. However, if your circumstances genuinely change – job loss, reduced hours, illness, or other hardship – contact us immediately. We’ll work with you to find a solution based on your new situation, whether that’s revised payment plans or reduced payments.

Legal action is only ever a last resort when members stop engaging with us entirely. Keep talking to us in good faith, and we’ll keep working with you.

Building Your Credit Score

While successfully repaying any loan can technically improve your credit score, payday loans create unique problems for future borrowing. Many mainstream lenders view payday loan usage negatively even when repaid on time, seeing it as evidence of financial difficulty. Mortgage providers are particularly cautious – some automatically reject applicants who’ve used payday loans within the past 12 months.

Missing payments damages your credit score severely, with defaults remaining on file for six years. Multiple payday loan applications also raise red flags with lenders. Successfully repaying a credit union loan, by contrast, demonstrates responsible borrowing and improves your access to better financial products in the future.

Who Can Join London Mutual Credit Union?

Many people assume credit unions have restrictive membership criteria, but if you live or work in London, there’s a good chance you’re eligible to join London Mutual Credit Union.

You can join if you:

- Live or work in Lambeth, Southwark, Westminster, or Camden

- Work for Transport for London

- Are a member of the UK armed forces

- Work in a healthcare occupation anywhere in Greater London (including NHS nurses, doctors, allied health and private healthcare assistants)

- Work in an education occupation anywhere in Greater London (including teachers, teaching assistants, school administrators, university staff)

This covers hundreds of thousands of Londoners, from Tube drivers to nurses, service personnel to teachers, and everyone in between.

This year’s Christmas loan borrowing deadline

If you’re planning to borrow for Christmas, time is important. London Mutual Credit Union’s Christmas loan application deadline is 9 December 2025. This gives the credit union time to process applications, conduct affordability checks, and ensure funds reach you in time for your festive spending.

Don’t leave it to the last minute. Applying early means:

- We have time to properly consider your application

- No rush decisions that might lead to borrowing more than you need

- Funds available when you need them for Christmas shopping

- Reduced stress during an already busy time

The best approach to Christmas borrowing is to plan ahead. If you know you’ll need to borrow, contact London Mutual Credit Union as early as possible. The earlier you apply, the more time you have to discuss your options and find the right borrowing amount for your circumstances.

How to apply

Applying to London Mutual Credit Union is straightforward:

- Visit the website: Learn more about our loans to see if there’s something right for you. You can apply online here

- Complete the application: You’ll be asked about your personal details, income, and the amount you wish to borrow

- Become a member: You can join and apply for a loan in the same process – no need to be a member first

- Application review: The credit union will assess your affordability and contact you if they need any additional information

- Receive your decision: You’ll hear back from us in a maximum of 10 days.

- Set up your account: If approved, you’ll receive your credit union account details and loan agreement

- Receive your funds: Once we set everything up, your loan is transferred to your account

For those on benefits, remember you’ll need to contact HMRC or DWP to redirect payments before your loan is released.

Making the a choice that’s right for you this Christmas

Christmas should be a time of joy, not financial stress that extends well into the new year. If you’re considering borrowing to cover festive expenses, it’s worth comparing what different lenders offer.

London Mutual Credit Union offers:

- Interest rates a fraction of payday lender charges (42.58% vs 200-1600%+)

- Real savings of £60-£200+ on typical Christmas loans

- Manageable repayment terms that don’t leave you struggling

- Benefits-based repayment options for security and peace of mind

- Save-as-you-repay to build your financial resilience

- Member-focused support if circumstances change

- Better prospects for future borrowing through responsible lending

- Protection from high-cost lending practices

Payday lenders typically offer:

- APRs routinely exceeding 200%, 500%, or 1,000%

- Higher costs that can reach double the amount borrowed

- Short repayment terms with high monthly payments

- Risk of debt cycles and repeat borrowing

- Firmer collection practices

- Potential impact on future borrowing, especially mortgages

On measures like cost, repayment terms, and long-term financial impact, credit unions typically provide better value for borrowers.

Building resilience beyond Christmas

While this article focuses on Christmas borrowing, London Mutual Credit Union offers much more than just loans. The most powerful benefit of credit union membership is breaking the cycle of expensive borrowing. By using save-as-you-repay and continuing to save after your loan is cleared, you can reach a point where you never need to borrow for Christmas again.

Imagine next December, knowing you have £500, £700, or £1,000 saved specifically for Christmas. No stress, no debt, no expensive interest charges – just money you’ve set aside throughout the year. That’s the power of credit union membership and the save-as-you-repay approach.

What about larger amounts?

The examples in this article focus on smaller loans typical for Christmas borrowing (£300-£1,200), with rates designed to be competitive with payday lenders for those who might otherwise turn to high-cost credit, especially if you’re unemployed, retired, or not working right now.

However, even more competitive rates may be available to some members, especially if you’re employed or have a strong credit history. If you’re in employment, you could access:

- Loans from £100 at 19.50% APR

- Larger loans up to £5,000 at rates as low as 13.68% APR

These rates compare well against credit cards and overdrafts, not just payday lenders. Whether you need £300 for gifts, £1,500 to cover Christmas plus unexpected expenses, or £5,000 for Christmas and home improvements, LMCU offers rates that compare favourably with mainstream credit options.

For larger amounts, the savings compared to credit cards (typically 22-30% APR), arranged overdrafts (up to 40% APR), or high-cost credit become even more significant. A £3,000 loan for 18 months at 13.68% APR would cost substantially less than the same amount on a typical credit card.

Alternative Options to Consider

While London Mutual Credit Union provides excellent value, it’s worth considering whether borrowing is necessary. Before applying for any loan, you might want to explore:

- Could you spend less? Christmas doesn’t have to be expensive to be special. Setting a budget and finding creative, lower-cost ways to celebrate can reduce or eliminate the need to borrow. Why we overspend at Christmas

- Do you need to buy it now? Not every Christmas expense is essential. Some gifts might wait until January sales when prices are lower.

- Could you increase income? Use a benefits tool to get a handle on what extra help you might be eligible for

- Do you have anything to sell? Decluttering before Christmas and selling unwanted items can raise cash without borrowing.

If you’ve considered these alternatives and still need to borrow, comparing rates and terms from different lenders can help you find the most affordable option. For Londoners eligible to join, London Mutual Credit Union offers competitive rates and member-focused service.

The bottom line: compare before you borrow

This Christmas, comparing borrowing costs can help you make an informed decision. Here’s what the numbers show:

- Borrowing £300 from Lending Stream over 6 months costs £278.36 in interest

- Borrowing £300 from London Mutual Credit Union costs £32.28 in interest

- Difference: £197.83

- Borrowing £300 from Mr Lender costs £252.00 in interest

- Borrowing £300 from London Mutual Credit Union costs £32.28 in interest

- Difference: £219.72

These savings represent money that could stay in your pocket – available for your family, savings, or reducing the need to borrow next Christmas.

Different lenders take different approaches. High-cost lenders charge premium rates for quick access to cash. Credit unions focus on affordable credit to help members build financial resilience, so that borrowing is a stepping stone – not a trap.