Next Friday (26th) is one of the biggest shopping days of the year in the UK, and no matter how hard you try to ignore the sales, we know how tempting it is to shop. According to Statista.com, Brits are estimated to spend around £9.42 billion over the Black Friday weekend this year… That’s a lot of discounted TVs and bargain Christmas pressies.

We’ve put together a list of tips and tricks to make sure you don’t overspend or get yourself into financial problems this November.

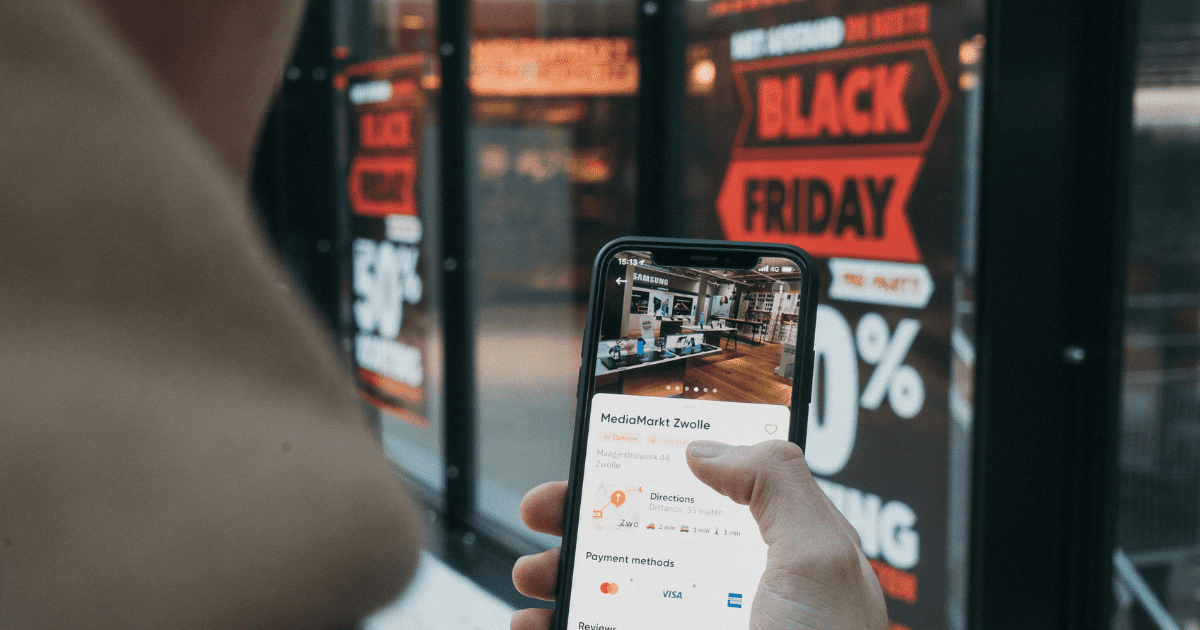

Don’t fall for Sneaky Black Friday deals

Retailers will use lots of tactics to pressure you into buying a product. The aim of this is to make you think that if you don’t buy now then you’ll have missed your chance at getting a bargain… FOMO. Some tactics to look out for are:

- Claiming that the original price of a product was much higher than the discounted sale price

- Products which are regularly on sale or offered at a discounted price a.k.a anchor pricing

- Pressure selling – when a product page tells you that ’50 other people are viewing this item’ or ’10 people bought this in the last hour’

You should also keep in mind that Black Friday sellers may be promoting a massive discount for ‘one day only,’ but how trustworthy is this claim?

In 2019 Which.com tracked the prices of 220 home and tech products advertised as ‘Black Friday deals’ across multiple retailers for six months before and after the event. They found that 85% of the products were the same price or cheaper at other times of the year. And 98% either returned to their Black Friday price in the six months after or fell to an even lower price.

Be Aware of Fake Reviews

5-star reviews do not always mean that the product is a 5-star product. Sometimes retailers will encourage their customers to leave 5-star reviews with the incentive of cash-back, store points or discount codes. This results in lots of genuine reviews being drowned out by untrustworthy positive reviews.

A good tactic when looking at reviews is to focus on the 4 and 3-star reviews. While these comments might not be singing the praises of the product, they’re more likely to be honest and genuine.

Look out for Scams

Black Friday is prime time for scammers to target online shoppers and bargain hunters. Two simple tips to stick to are:

- Shop from companies you know and trust

- Be wary of texts and emails claiming to offer big discounts – they could include harmful links

Take a look at our blog posts on Scams to be Aware of, and Delivery Tracking Scams, for more details.

Try not to Impulse buy

It’s hard to resist impulse buying when you’re surrounded by ‘unmissable discounts.’ This is why it’s a good idea to plan your Black Friday purchases in advance.

If there are certain items you are looking to get for cheaper on Black Friday, like a new air fryer or your partners Christmas Present, it’s worth shopping around the week before and adding the ones you like to your wish list. That way you know exactly what you want, and can buy the one with the best discount. This will save you from being distracted by other items and flashy sale signs on the day.

Borrow Responsibly

November through to January are some of the most expensive months of the year. Many Brits will take out loans over the festive period to cover the costs of Christmas and New Year. If you choose to borrow this year, make sure you really look into your options.

Your local credit union is likely to have lower rates than other lenders and offer a fairer way of borrowing. Be aware of loan sharks around this time of year, they may target those who they think are likely to borrow. Find out more about loan sharks here.

Credit Union Christmas Loans

Avoid credit cards and online lenders this Christmas. Save hundreds of pounds with a Christmas loan from your local credit union, with the options to repay from your salary, child benefit or your membership account. Apply online today.

Free trial