Online gambling is everywhere these days, and it’s easy to see the appeal – especially when you’re dealing with the stresses of military life. A quick bet can feel like a harmless way to unwind after a tough day or add some excitement during quiet periods.

For many people, that’s exactly what it remains – occasional entertainment that fits within their budget. But sometimes, without really noticing, gambling can start taking up more of your time, money, and headspace than you initially planned.

When gambling becomes a concern

We know this can be a difficult topic to think about, let alone talk about. Nobody starts gambling thinking it will become a problem. But if you’re reading this and some of it feels familiar, you’re definitely not alone.

It’s worth remembering that the effects can be subtle at first. You might not notice the gradual shift from occasional fun to something that’s taking up more space in your life than you’d like.

Money concerns you might recognise:

- Finding yourself short of cash before payday more often

- Using money you’d earmarked for bills or family expenses

- That sinking feeling when you realise you’ve spent more than you meant to

- Borrowing from mates or family to cover basics after a gambling session

- Reaching for your credit card when the money’s gone but the urge to play hasn’t

How it might be affecting your daily life:

- Snapping at family or friends over money worries

- Making excuses about why you can’t join social activities (usually because money’s tight)

- Finding yourself thinking about gambling when you should be focused on other things

- Feeling guilty or anxious about how much you’ve been gambling

- Lying about where money’s gone or how much you’ve actually spent

For military personnel, there’s an extra layer of worry: serious financial problems like bankruptcy or IVAs need to be reported up the chain of command, which could affect your career or security clearance. It’s another reason why getting help early makes sense.

The cycle of chasing losses

You know that feeling when you think “I’ll just put one more bet on to win back what I’ve lost”? It’s incredibly common, but it’s also where things can really start to spiral. What starts as trying to break even can quickly become much bigger losses, creating a cycle that gets harder and harder to step away from.

If you’re finding yourself chasing losses or gambling larger amounts to feel the same excitement you used to get from smaller bets, that’s your brain telling you that gambling has become more than just entertainment.

Available support and resources

Gambling problems are more common than many people realise, and there are excellent support services available specifically designed to help people regain control.

Talk Ban Stop provides a comprehensive approach to gambling support:

- Talk: Free, confidential advice through GamCare’s National Gambling Helpline (0808 8020 133), available 24 hours a day with live chat options

- Ban: Gamban software that blocks access to gambling websites and apps across all your devices (free for those accessing support services)

- Stop: GAMSTOP self-exclusion from all UK licensed gambling operators

These services are completely confidential and designed to work around your military commitments.

Military-specific support

The Armed Forces also provide internal support systems:

- Unit welfare officers can provide confidential guidance

- Military charities often have financial counselling services

- Some bases have financial education programmes

These services understand the unique pressures of military life and can provide support that takes your career considerations into account.

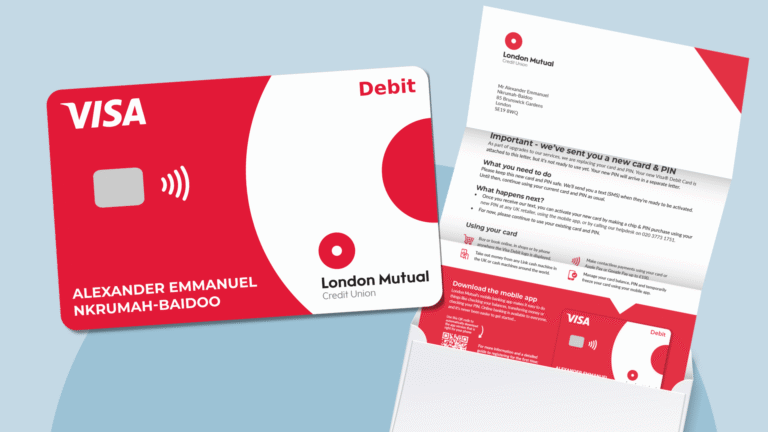

How London Mutual Credit Union can help

As holders of the Armed Forces Covenant Bronze Award, we understand the financial challenges military personnel face. When we see members whose finances might be affected by gambling, we can:

- Connect you with appropriate specialist support services

- Provide financial guidance that takes your military circumstances into account

- Discuss lending options that support your financial recovery rather than adding to problems

- Offer savings products that help rebuild financial stability

Our loan products include features that prevent borrowed money being used for gambling, supporting your recovery goals rather than working against them.

Taking action early

The earlier you recognise and address gambling concerns, the easier it typically is to regain control. This might mean:

- Setting spending limits on gambling apps and websites

- Using blocking software during vulnerable periods

- Speaking to someone about what’s driving the gambling

- Taking a complete break from gambling to reassess

Financial recovery after gambling problems

If gambling has affected your finances, there are practical steps that can help rebuild stability:

- Create a realistic budget that accounts for essential expenses first

- Consider whether debt consolidation might help manage multiple payments

- Build an emergency fund to reduce the temptation to gamble when unexpected costs arise

- Focus on savings goals that provide positive financial momentum

Getting help doesn’t affect your career

It’s worth emphasising that seeking help for gambling problems is not something that needs to be reported to your chain of command. Getting support early is a responsible financial decision that demonstrates maturity, not weakness.

Professional gambling support services are completely confidential and designed to help you regain control before problems affect other areas of your life, including your military career.

Moving forward

Gambling problems are highly treatable, and many people successfully regain control over their finances and gambling behaviour with the right support. The key is recognising when gambling has moved beyond entertainment and taking action before the problems escalate.

If gambling is affecting your finances or wellbeing, contact GamCare on 0808 8020 133 or visit gamcare.org.uk for confidential support designed around your needs as a service member.