Southwark Council has launched a new scheme giving every 11-year-old child in the borough a £20 voucher to open a savings account with London Mutual Credit Union.

The Southwark Smart Savers initiative targets children at a key stage as they prepare for secondary school, aiming to build good money habits that will last into adulthood.

Year six pupils have until the end of November 2015 to sign up for the programme, which teaches young people about responsible money management from an early age.

How the scheme works

Children can claim vouchers by visiting any London Mutual Credit Union branch with their voucher letter, proof of address, and birth certificate or passport. To be eligible, children must have been born between 1st September 2003 and 31st August 2004.

Young account holders can then make deposits and withdrawals with a parent or guardian, gaining hands-on banking experience whilst learning about saving, budgeting and handling money responsibly.

The council has written to parents of all eligible children explaining how to claim their free £20 voucher. Children who sign up are also automatically entered into a prize draw to win an iPad.

Building financial skills early

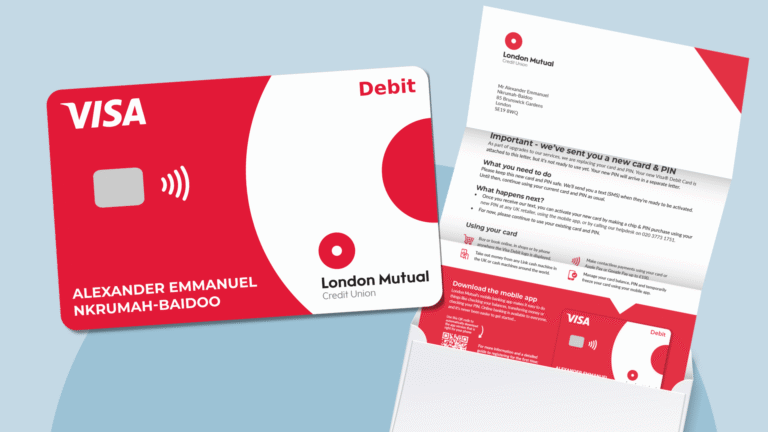

London Mutual Credit Union currently has more than 1,700 young savers, and this new scheme has the potential to increase that number significantly across Southwark.

The initiative reflects the council’s commitment to giving all children equal access to financial services and teaching them about community banking alternatives.

The scheme is designed to help young people develop positive habits around planning and goal-setting as they prepare to become adults who understand how to manage money effectively.

Parents and guardians of 11-year-olds in Southwark are encouraged to take advantage of the opportunity whilst vouchers remain available until the end of November.