The pandemic saw a surge in online phishing scams and fraud, with criminals targeting people via email, phone and even social media. It was reported that between April 2020 and April 2021 over £2.3bn was lost by victims of scams.

Although the lockdowns may seem like a thing of the past, the threat of scams is still apparent. Sadly, it’s clear that scammers are constantly changing their tactics and finding new ways of targeting consumers.

With the run-up to Christmas (arguably the most expensive time of the year), and big shopping dates like Black Friday lurking in the shadows — it may be worth asking yourself if that deal is a trick or a treat…

Here are some of the top scams to be aware of throughout the spooky season:

Phishing

‘Phishing’ is a tactic that scammers use to gain access to your sensitive information like login details or bank details. This is done to scam people out of money. Phishing usually happens digitally, and often comes in the form of fake emails claiming to be from a well-known or respectable source. With this type of scam, you might receive an email…

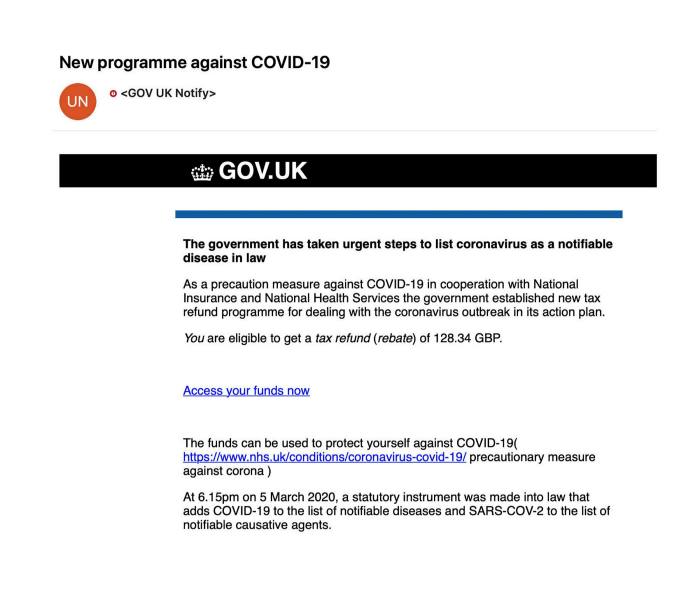

- Appearing to be from HMRC claiming you are owed a tax refund or claiming that you owe money. These emails usually include a link to claim/pay your money. DON’T click on the link. HMRC will never contact you about this via email, they are most likely to send a letter to your home address.

- Claiming to be from PayPal tricking you into thinking there’s an issue with your account. These emails also usually include a link to fix the problem. Don’t be fooled by these links, they could contain malicious software.

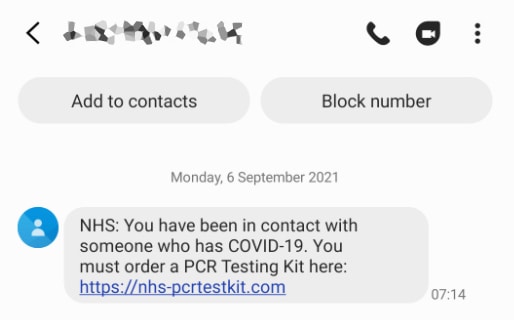

Smishing

Smishing a.k.a text scams are scams sent in an SMS message. The pandemic saw an increased number of businesses using SMS to contact their customers with marketing and updates. Scammers caught onto this and used similar messages to target people. These texts often include a link to click on or a number to call. These texts often include language that makes you feel spooked and panicked into taking action. You might have come across…

- Texts from Royal Mail or other delivery services saying you have missed your delivery and you must re-schedule it via a specific link. These texts can often come when you haven’t even ordered anything. Never click on the link.

- Fake PCR test texts from an anonymous number. Scammers are using panick techniques by sending people texts claiming that they must order a PCR test. If you get one of these, don’t be spooked. The NHS will never ask for payment for a test and would not message from a mysterious unknown number.

https://conversation.which.co.uk/scams/fake-nhs-pcr-test-contact-text-message/?utm_medium=email&utm_source=engagingnetworks&utm_campaign=scamalert180921&utm_content=Scam+alert+180921

Spear Phishing

Spear phishing is a more targeted form of scam (hence the name). This involves sending a scam message to a specific group of people or type of person. These messages are usually more detailed and will relate to the victim’s line of work or interests, making the content seem more legitimate.

For example, a scammer might get hold of the email addresses of some staff members of a specific company. They will then send an email around to these people, claiming to be from their CEO or manager. This is done to try and gain access to the systems or spread damaging software to the work desktops.

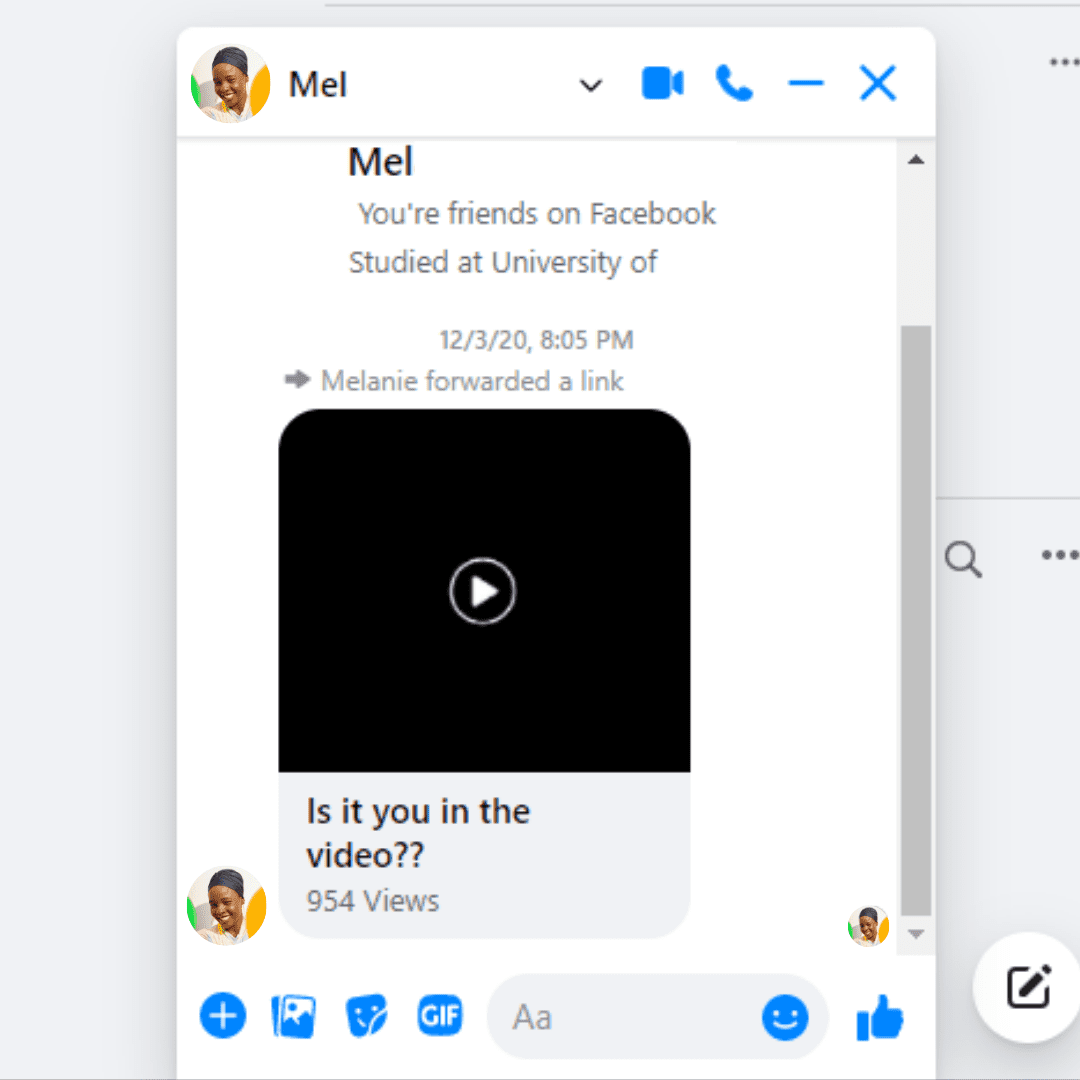

Social Media Phishing

People spend hours and hours on social media (I know I do). This makes social platforms the ideal hunting ground for a scammer to target victims. Facebook, Instagram, Twitter and LinkedIn are all popular platforms where scammers have found tactics to steal login details from users. A common scam seen on social media is…

- Receiving a message from a Facebook friend with a link to a video attached. The message might include language that makes you curious or worried to encourage you to click the link. These links usually contain malicious software and viruses.

Vishing

Although the ‘V’ in fishing doesn’t stand for Vampire, these types of scams can still bite. Scammers who contact their victims via voice call have the same goal as those who use text or email. These calls might come from…

- Someone pretending to be your phone or internet provider calling you to suggest installing or downloading some new software to make your service/broadband better. This is a tactic that hackers use to gain access to your device and to your personal credentials.

- Someone pretending to be your bank calling to ask you to confirm some personal details. Remember that your bank will never ask for your log in details, PIN or passwords over the phone.

See if you can beat our Scams Quiz…

How likely are you to spot a scam? Find out in our scams quiz!

start here