When the HMT Empire Windrush arrived at Tilbury Docks on 22 June 1948, the 492 men, women, and families on board brought more than just hope for new lives in Britain. They brought ideas about community finance that would eventually transform how thousands of people across the country access fair banking services.

This lesser-known chapter of the Windrush story shows how people facing discrimination and hardship came together to create financial institutions that still serve communities today – including right here in South London.

When the banks said no

The Windrush Generation arrived in Britain with dreams of homeownership, education for their children, and starting businesses. Many were skilled workers responding to adverts for help filling post-war labour shortages. But when they tried to access financial services, they often found doors closed.

Some banks explicitly refused to serve Caribbean customers. Others used bureaucratic barriers – demanding credit histories that new arrivals couldn’t possibly have, or setting interest rates that made borrowing unaffordable. The message was clear: traditional banking wasn’t designed for people like them.

Sound familiar? These same barriers still affect many communities across London today – recent migrants, people with irregular income, those living in areas banks consider “risky.” The problems the Windrush Generation faced haven’t disappeared; they’ve just evolved.

Building something better from scratch

Rather than accepting exclusion, members of the Windrush Generation drew on traditions they’d brought from Jamaica and other Caribbean islands. In 1964, ten members of Ferme Park Baptist Church in North London founded Hornsey Co-operative Credit Union – one of Britain’s first community credit unions.

The concept was simple but revolutionary: pool money together, lend to each other at fair rates, and build financial security as a community. No credit checks that discriminated against Caribbean names and addresses. No impossible paperwork. Just neighbours helping neighbours access the financial services that mainstream banks denied them.

For members, this meant being able to travel home to see family, start the businesses they’d dreamed of, or simply buy furniture for their homes without paying extortionate interest rates. But the credit union provided something even more valuable – a sense of community and solidarity in a country that often felt unwelcoming.

From survival to success

What started as a response to discrimination became a model for community finance. Caribbean communities across London and Britain founded their own credit unions. Irish communities followed suit, as did other groups who found themselves excluded from traditional banking.

These early credit unions didn’t just survive – they thrived. They proved that financial services could work differently, putting people before profits and communities before shareholders. They demonstrated that ordinary people could run successful financial institutions based on mutual support rather than exploitation.

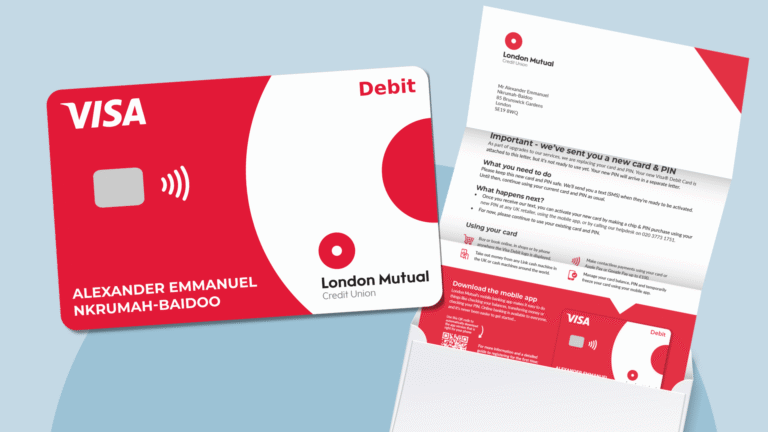

London Mutual Credit Union traces its roots to this movement. Founded in 1982 as Southwark Employees Credit Union, we grew from similar principles: financial services that actually serve the community, rather than extracting wealth from it.

The legacy lives on

Today, descendants of the Windrush Generation continue to play important roles in credit unions across Britain, including here at London Mutual. But the principles they established – community ownership, fair lending, financial inclusion – now serve much broader communities.

We still serve many of the same needs that drove the founding of those first credit unions. People locked out of mainstream banking because of where they live, what they earn, or where they were born. Families trying to build financial security in expensive areas like South London. Small business owners who can’t get fair lending from high street banks.

The methods have evolved – we offer digital banking, payroll deduction, and modern loan products – but the core mission remains the same. Financial services designed around what communities actually need, not what generates maximum profit for distant shareholders.

Why this history matters today

Understanding this history helps explain why credit unions work differently from banks. We’re not just alternative financial providers – we’re part of a tradition of community self-determination that goes back decades.

When London Mutual Credit Union assesses loan applications, we’re continuing the tradition of looking at people as individuals rather than just credit scores. When we offer savings accounts with fair terms, we’re following the example of those early members who pooled their resources to help each other succeed.

The Windrush Generation faced explicit discrimination that would be illegal today. But many of the barriers they overcame – poverty premiums, financial exclusion, services designed for middle-class consumers – still affect communities across London.

Community finance for today’s challenges

Just as Hornsey Co-operative Credit Union served Caribbean families building new lives in 1960s London, we serve diverse communities facing their own financial challenges today. Ukrainian families rebuilding lives after fleeing war. Young people locked out of homeownership by London’s housing costs. Workers in the gig economy whose irregular income makes traditional banking difficult.

The specific challenges change, but the solution remains the same: communities coming together to create financial services that actually work for real people’s lives.

At London Mutual Credit Union, we try to live up to the legacy of those pioneers who refused to accept financial exclusion and built something better. We serve Southwark, Lambeth, Westminster, and Camden because we believe every community deserves access to fair financial services, regardless of postcode or background.

Building on strong foundations

The story of the Windrush Generation and credit unions isn’t just historical – it’s a reminder of what’s possible when communities organise around shared needs rather than individual profit.

Those ten members of Ferme Park Baptist Church who founded Hornsey Co-operative Credit Union probably never imagined their small act of community self-determination would inspire a movement that now serves millions of people across Britain. But their example shows that when people work together, they can create institutions that serve communities for generations.

That’s the tradition we’re part of at London Mutual Credit Union – not just providing financial services, but continuing the work of building a fairer financial system that serves everyone, not just the wealthy.